Investor biases

It’s easy to get caught up in trying to find the ‘best’ investment at the ‘current’ point in time. However, as we know, investing is a long-term game. We also know that only looking retrospectively at investments can be detrimental to future decisions.

Recency bias, a behavioural bias that investors can often exhibit, leads investors to focus on the recent, short-term environment and commonly comes into play after periods of exceptional positive performance or extreme poor performance. At times it is also closely linked to hindsight bias, which is when an investor believes an event could have been predictable and leads to the belief that future events will be predictable. These biases can impact investment decision making.

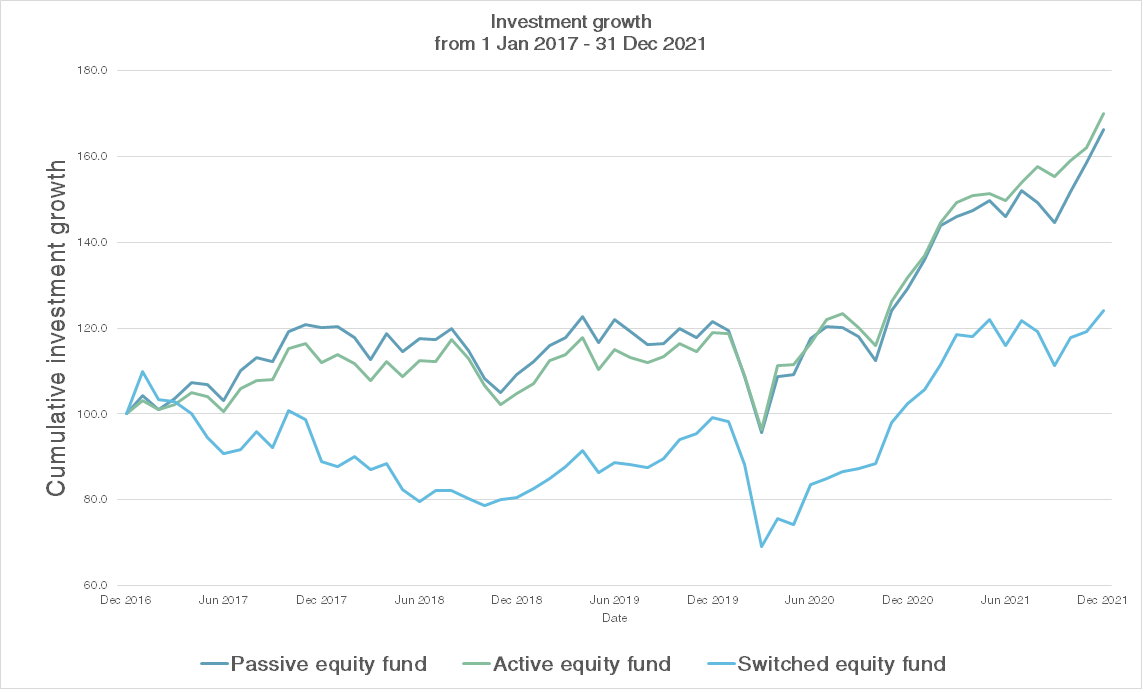

An illustration of this is a common misunderstanding of investing in yesterday’s winners (based on hindsight), and that the performance will continue (based on recent performance). The example below considers the outcome if an investor switched into the prior year’s best performing local equity fund. This exercise entails a switch at the beginning of every year, into last year’s best fund, over a 5-year period from 1 January 2017 to 31 December 2021. For reference, this ‘switched equity fund’ is compared to a local passive equity fund as well as a local active equity fund*.

Data source: Factset, Morningstar Direct & Analytics Consulting; Data period: 01 January 2017-31 December 2021

*The fund universe over the period analysed (2017 – 2021) was the ASISA South African Equity General category. Only surviving unit trusts and those that would be accessible were considered.

From the above, it’s evident that the switching would have been detrimental to investment growth, versus staying invested in one fund over the investment period (not even mentioning the emotional stress it may cause trying to maneuver and market time, year by year).

It’s easy to get caught up in short-term mindset which may lead to less optimal investment decisions being made. Especially during periods of extreme over and under performance, it can be tempting to chase past winners or respond reactively. It is crucial to stay committed to your investment objectives and to focus on the long-term, while not getting swayed by short-term events.

Maintain your course, stay invested…